Historische resultaten voor Renault Group in 2023 – sterke verbetering van alle financiële cijfers

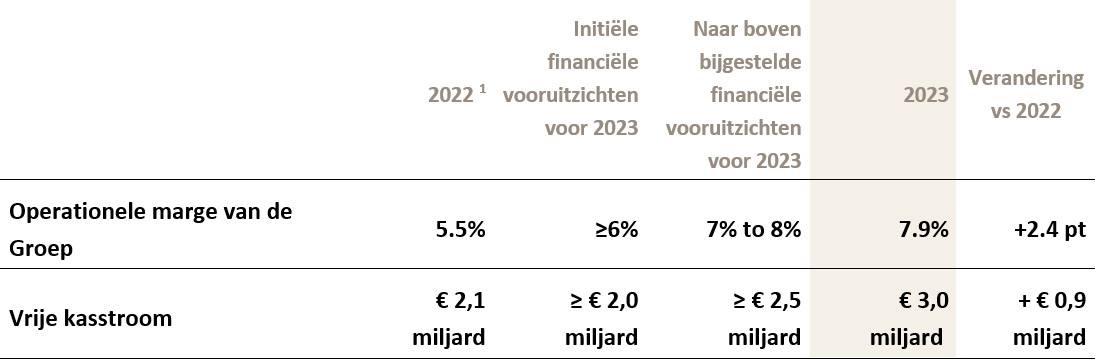

- Resultaten overtreffen de financiële vooruitzichten voor het boekjaar 2023 (aangepast in juni 2023):

- Sterke verbetering van alle financiële cijfers met recordniveaus:

- Groepsomzet: € 52,4 miljard, +13,1% en +17,9% bij constante wisselkoersen versus 2022.

- Record operationele marge van de Groep: € 4,1 miljard of 7,9% van de omzet (+2,4 punten vergeleken met 2022), € 1,5 miljard hoger dan in 2022.

- Record operationele marge afdeling Auto: € 3,1 miljard of 6,3% van de omzet (+3,0 punten vergeleken met 2022), € 1,6 miljard hoger dan in 2022.

- Nettowinst: € 2,3 miljard, € 3,0 miljard hoger dan in 2022.

- Record vrije kasstroom: € 3,0 miljard, € 0,9 miljard hoger dan in 2022.

- Netto financiële positie sector auto’s op historisch niveau: € 3,7 miljard op 31 december 2023 (€ 3,2 miljard hoger dan op 31 december 2022).

- ROCE meer dan verdubbeld: 28,5% in 2023 versus 12,6% in 2022.

- Orderboeken in Europa al voor 2,5 maanden gevuld.

- Renault Group terug in de spotlights dankzij succesvolle vernieuwing van zijn line-up. In 2023 had Renault Group in Europa 2 modellen in de top 3 van bestverkochte auto’s en steeg het merk Renault van de 5e naar de 2e plaats.

- In 2024 zullen een productoffensief met 102 lanceringen en versnelde kostenbesparingen de drijvende krachten zijn achter operationele prestaties en een sterke kasstroom generatie. Renault Group wil in 2024 het volgende bereiken:

- Renault Een operationele marge van de Groep ≥7,5%.

- Een vrije kasstroom ≥ € 2,5 miljard.

- Een aanzienlijk hoger dividend van € 1,85 zal ter stemming worden voorgesteld aan de Algemene Vergadering van 16 mei 2024 versus € 0,25 per aandeel voor boekjaar 2022 (+€ 1,60 per aandeel).

Luca de Meo, CEO van Renault Group: “Renault Group heeft recordresultaten geboekt. Dat is het gevolg van fantastisch teamwerk en weerspiegelt het succes van onze Renaulution-strategie. Onze fundamenten zijn nog nooit zo solide geweest en daar zal het niet bij blijven. In 2024 zullen we profiteren van een ongekend aantal lanceringen die de vernieuwing van de Renault Group onder de aandacht brengen, terwijl we onze kostenstructuur blijven optimaliseren. Tegelijkertijd krijgt de transformatie van de Groep ongelooflijk snel vorm, waarbij we belangrijke stappen zetten voor wat betreft onze grote projecten en onze EV- en softwarestrategie versnellen. Onze organisatie onderscheidt zich door zijn flexibiliteit en goede prestaties. Hiermee maken we een vuist in een uitdagende omgeving! Ik wil de teams bedanken voor deze prestaties. Met z’n allen dragen we bij aan een nieuwe Renault Group die veel efficiënter en effectiever is en waarde creëert voor alle stakeholders.”

Commercial results

- 3 complementary and growing brands:

- Worldwide Group’s sales up 9% versus 2022 to reach 2, 235,000 units. In Europe[3], sales were up 18.6% in a market up 13.9%.

- Renault is the best-selling French brand in the world, 2nd place in the European PC+LCV[4] market, leader in the European LCV[5] market, leading position in France in PC and LCV. Clio became the best-selling car in France in 2023, all sales channels combined and is #3 in Europe.

- Dacia ranked 11th on the European PC + LCV market (+ 4 places). In the European PC market, Dacia joins the top 10. The brand confirms its 2nd place on the retail vehicle market in Europe[6], its core market.

- Alpine sales were up 22.1% versus 2022. The Alpine A110 maintains its position as the leading two-seater sports coupé sold in Europe in 2023.

- A commercial policy focused on value and already benefitting from the beginning of the unprecedented product offensive:

- Renault brand sales in C-segment and above in Europe improved by 26% compared to 2022, thanks to the success of Arkana, Austral, Espace E-TECH Hybrid and Megane E-TECH Electric. C & above segments represented 42% (+ 3 points vs 2022) of Renault brand sales mix in Europe in 2023.

- 65% of Group sales were on the retail channel in the Group’s five main countries in Europe[7]. Renault brand generated more than half of its sales in the retail channel.

- A successfulelectrification offensive:

- Renault brand took the 3rd place in Europe for electrified[8] passenger car with sales up 19.7% versus 2022. They accounted for 39.7% of the brand’s PC sales in Europe (of which 11.3% EV). This trend was supported by a 62% increase in hybrid vehicle (HEV) sales. Austral, Clio and Captur are among the top 10 best-selling hybrid vehicles in Europe.

- Dacia already started its smooth electrification strategy: Dacia Jogger Hybrid 140, on sale since January 2023, represents more than 25% of Jogger orders and Dacia Spring, 100% electric, held on to its place in the top-three European4 retail electric vehicles sales.

- In 2023, Renault Group confirms it achieved its CAFE[9] targets (passenger cars and light commercial vehicles) in Europe.

Financial results

The consolidated financial statements of Renault Group and the company accounts of Renault SA at December 31, 2023 were approved by the Board of Directors on February 14, 2024 under the chairmanship of Jean-Dominique Senard.

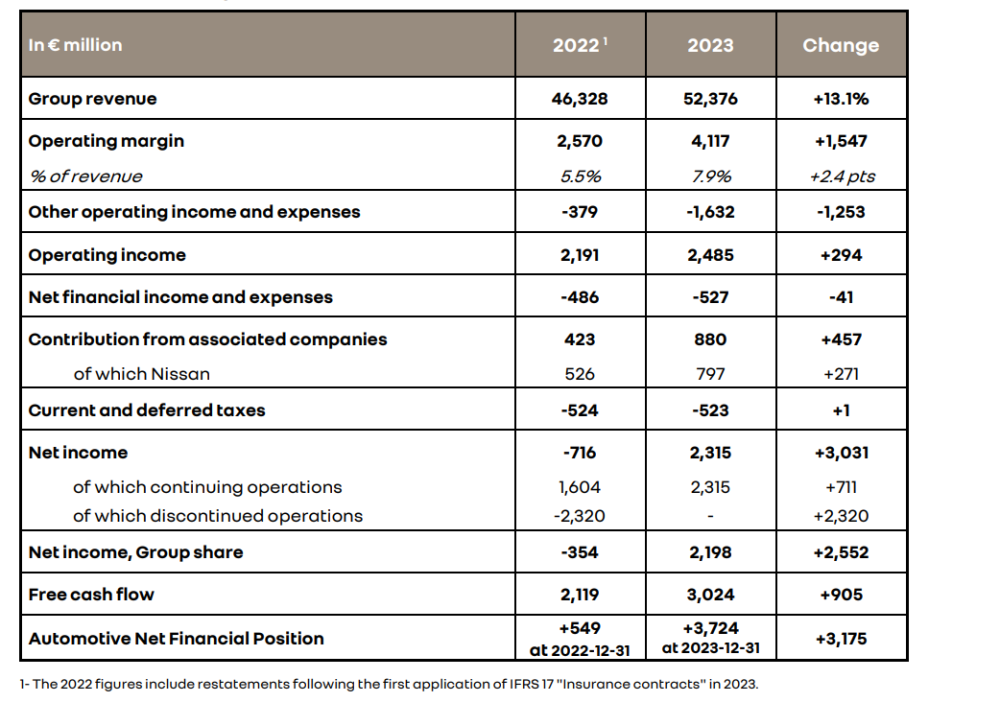

Group revenue reached €52,376 million, up 13.1% compared to 2022. At constant exchange rates[10], it increased by 17.9%.

Automotive revenue stood at €48,150 million, up 11.7% compared to 2022. It includes 4.8 points of negative exchange rates effect (€2,068 million) mainly related to the Argentinean peso and to a lesser extent to the Turkish lira devaluation. At constant exchange rates1, it increased by 16.5%.

- Volume effect stood at +4.0 points thanks to the commercial success of vehicles.

The 9% increase in registrations translates into 4 points of volume effect due to the lower restocking within the dealership network compared to the end of 2022. This improvement on total inventories is better than our objective of being below 500,000 units at the end of the year. - The price effect, positive by +7.4 points, continued to be very strong and reflects the Group’s commercial policy focused on value over volume, vehicles enrichment as well as price increases to offset currency effect.

- The geographic mix impacted positively by +1.7 points thanks to the strong sales performance in Europe.

- The product mix effect stood at +1.0 point mainly thanks to the success of Austral, Espace E-TECH Hybrid and LCVs. The success of Clio had a negative impact on this item as its average selling price is below the Group’s average selling price.

- Sales to partners had a positive effect of 2.1 points, supported by the production of the ASX (since the beginning of the year 2023) and Colt (since October 2023) for Mitsubishi Motors as well as a dynamic LCV business with Nissan, Renault Trucks and Mercedes-Benz.

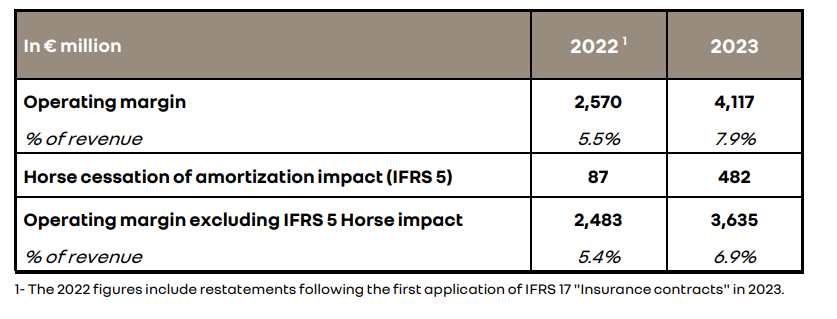

The Group posted a record operating margin at 7.9% of revenue versus 5.5% in 2022, up 2.4 points. It continued to improve sequentially from 6.3% in 2022 H2 to 7.6% in 2023 H1 and 8.1% in 2023 H2. It stood at €4,117 million, up €1,547 million versus 2022.

Group operating margin includes, since the beginning of November 2022 and until the deconsolidation of Horse, a positive non-cash effect of the cessation of amortization for these assets held for sale. It accounted for €482 million in 2023 (€275 million in 2023 H1 and €207 million in 2023 H2). Year‑on‑year, it represented a positive effect of €398 million.

Adjusted from this positive impact, the Group operating margin would have been 6.9% in 2023 with 6.6% in 2023 H1 and 7.3% in 2023 H2.

Automotive operating margin also reached a record level at 6.3% of Automotive revenue in 2023, up 3.0 points versus 2022. It stood at a record €3,051 million in 2023 versus €1,402 million in 2022.

- Automotive operating margin was strongly impacted by a negative forex of -€595 million mainly due to the Argentinean peso.

- The positive volume effect at +€621 million and the positive mix/price/enrichment effect of +€2,908 million illustrated the success of vehicles and of the commercial policy focused on value. The positive mix/price/enrichment effect more than compensated the increase in costs. This increase amounted to -€1,630 million and is mainly explained by the impact of the carry-over of raw materials and energy price increases, logistics and labor costs.

- SG&A increased by €389 million, mainly driven by marketing costs due the ongoing product offensive and salary increases.

- The price reevaluations in Argentina, computed in the Renault Group’s subscription plan in the country, explained most of the +€376 million effect in the “others” item.

The contribution of Mobilize Financial Services (Sales Financing) to the Group’s operating margin reached €1,101 million versus €1,198 million in 2022[11] due to non-recurring impacts of the swaps valuation linked to the interest rate increase in Europe since beginning 2022. Excluding this one-off, Mobilize Financial Services would have posted an operating margin up 8% compared to 2022. This evolution was mainly driven by the increase in new financings and lower cost of risk.

Other operating income and expenses were negative at -€1,632 million (versus -€379 million in 2022). This amount was mainly driven by -€0.9 billion of capital loss on the disposal of Nissan shares made in December 2023, -€0.5 billion of impairment on vehicles developments and specific production assets and by restructuring costs. Capital gain on asset disposals amounted to +€0.3 billion, related to the sale of land in Boulogne-Billancourt, of several commercial subsidiaries of the Group and of branches of Renault Retail Group.

After taking into account other operating income and expenses, the Group’s operating income stood at €2,485 million versus € 2,191 million in 2022 (+€294 million versus 2022).

Net financial income and expenses amounted to -€527 million compared to -€486 million in 2022. The increase is explained by the impact of hyperinflation in Argentina partially offset by the positive impact of the rise in interest rates on the net cash position.

The contribution of associated companies amounted to €880 million compared to €423 million in 2022. This included €797 million related to Nissan’s contribution.

Current and deferred taxes represented a charge of -€523 million, stable compared to 2022 (-€524 million in 2022). The increase in the pre-tax income, related to the improvement in performance, was offset by the evolution of deferred taxes.

Thus, net income stood at €2,315 million, up €3,031 million compared to 2022 and net income, Group share, was €2,198 million (or €8.11 per share). As a reminder, in 2022, net income from discontinued operations amounted to -€2,320 million due to the non-cash adjustment related to the disposals of the Russian industrial activities.

The cash flow of the Automotive business was at record level in 2023 and reached €5,485 million, up €667 million versus 2022. It includes €600 million of Mobilize Financial Services dividend versus €800 million in 2022. This cash flow significantly more than covered the tangible and intangible investments before asset disposals which amounted to €2.9 billion (€2.6 billion net of disposals) and the restructuring expenses (€0.5 billion).

Excluding the impact of asset disposals, the Group’s net CAPEX and R&D stood at €3,817 million in 2023, representing 7.3% of revenue compared to 7.4% of revenue in 2022. It amounted to 6.7% including asset disposals.

Free cash flow[12] reached a record level at €3,024 million. Excluding Mobilize Financial Services dividend, it stood at €2,424 million versus €1,319 million in 2022, up €1,105 million. The change in working capital requirement was positive at €637 million and is mainly related to the decrease in inventories.

As of December 31, 2023, total inventories of new vehicles (including the independent dealer network) represented 484,000 vehicles, better than our objective, and compared to 569,000 vehicles at the end of June 2023 and 480,000 vehicles at the end of December 2022.

The Automotive net financial position stood at €3,724 million on December 31, 2023 compared to €549 million on December 31, 2022, an improvement of €3,175 million. In 2023, it included the following operations:

- €764 million corresponding to the sale of 211,000,000 Nissan shares held in a French trust, implemented as per new Alliance Agreement;

- €200 million representing a 24% equity stake investment in Alpine Racing Ltd (United Kingdom) by Otro Capital, RedBird Capital Partners and Maximum Effort Investments.

The loan of a banking pool benefiting from the guarantee of the French State (PGE) is now fully reimbursed (one year in advance).

Liquidity reserve at the end of December 2023 stood at a high level at €17.8 billion, up €0.1 billion compared to December 31, 2022.

Capital allocation

Renault Group intends to share value creation with its stakeholders through an employee shareholding plan and through its dividend.

Renaulution employee shareplan

Since 2022, Renault Group is taking steps to increase the share of employees in its capital to reach 10% by 2030.

In 2023, more than 95,000 employees benefitted from 8 free shares. Among them, nearly 38,000 also subscribed to shares at a preferential price of 26.28 euros per share. In total, with nearly 2.1 million additional shares held by employees, this second Renaulution Shareplan operation represented 0.7% of Renault Group’s capital.

Employees hold 5.07% of the capital at December 31, 2023.

Dividend

The proposed dividend for the financial year 2023 is €1.85 per share, up €1.60 per share versus last year. The payout ratio is 17.5% of Group consolidated net income – parent share[13]. It would be paid fully in cash and will be submitted for approval at the Annual General Meeting on May 16, 2024. The ex-dividend date is scheduled on May 22, 2024 and the payment date on May 24, 2024.

As announced during its Capital Market Day, the dividend policy will gradually grow, in a disciplined manner, up to 35% payout ratio of Group consolidated net income – parent share, in the mid-term. To do so, the Group must achieve its first priority: return to an “investment grade” rating.

2024 Outlook

2024 product offensive and the acceleration of cost reduction will be the drivers of operational performance and strong cash generation:

- Product launches: 2024 will be a historic year with 10 new vehicles launches[14]

- Renault brand: 7 new vehicles launches[15]:

- 2 new all-electric vehicles with Scenic E-TECH electric, offering more than 600 km of WLTP range, and Renault 5 E-TECH electric – all-electric pop icon

- 2 new hybrid vehicles in Europe, including Rafale E-TECH

- New Renault Master (ICE and all-electric versions)

- 2 new vehicles in markets outside Europe: Kardian and a Renault Korea Motors vehicle

- In 2024, the Renault brand will continue to roll out the “International Game Plan 2027”. After Brazil and Turkey in 2023, this year will be highlighted by the deployment of the plan in Morocco and South Korea

- Dacia:

- New Dacia Duster on sale starting March 2024

- The new 100% electric Dacia Spring, with an all-new design, both exterior and interior, on sale in summer 2024

- The brand will also reveal Bigster, a C-segment vehicle, at the end of 2024

- Alpine:

- Alpine will continue its international deployment with its arrival in Turkey in H1 2024

- 2024 will mark Alpine’s shift into electric. The brand will present its electric hot hatch, the Alpine A290, its first all-electric vehicle

- Renault brand: 7 new vehicles launches[15]:

- Faster cost reductions and time-to-market:

- Reduction of production costs per vehicle by 30% for thermal vehicles and 50% for electric vehicles between now and 2027, thanks to the Industrial Metaverse.

- This production cost reduction will also fuel Ampere target to reduce variable costs between the 1st and the 2nd generation of C-segment electric vehicles by 40% by 2027+, following a continuous trajectory.

In 2024, European and Latin America automotive markets are expected to be stable, and Eurasia is expected to decline by 11%.

In this context, Renault Group is aiming to achieve in 2024:

- A Group operating margin ≥7.5%

- A free cash flow ≥€2.5bn

Renault Group’s consolidated results

Horse accounting impacts

No impact from Horse on free cash flow for 2022 and 2023.

Additional information

The consolidated financial statements of Renault Group and the company accounts of

Renault SA at December 31, 2023 were approved by the Board of Directors on February 14, 2024.

The Group’s statutory auditors have conducted an audit of these financial statements and their report will be issued shortly.

The earnings report, with a complete analysis of 2023 financial results including condensed financial accounts, is available at www.renaultgroup.com in the “Finance” section.

2023 Financial Results Conference

Link to follow the conference at 8am CET on February 15th, and available in replay: events.renaultgroup.com/en/

[1] The 2022 figures include restatements following the first application of IFRS 17 “Insurance contracts” in 2023.

[2] 10 new vehicles launches in 2024 without Renault Duster (outside Europe) and Captur facelift.

[3] ACEA European Scope.

[4] PC+LCV: passenger car + light commercial vehicle.

[5] Excluding pickup trucks.

[6] Austria, Belgium, Croatia, Czech Republic, Denmark, Finland, France, Germany, Hungary, Italy, Luxembourg, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, United Kingdom.

[7] France, Germany, Spain, Italy, United Kingdom.

[8] Includes EV, Hybrid (HEV) and Plug-In Hybrid (PHEV), excludes Mild-Hybrid (MHEV).

[9] The official results will be released by the European Commission in the coming months. CAFE = Corporate Average Fuel Economy.

[10] In order to analyze the variation in consolidated revenue at constant exchange rates, Renault Group recalculates the revenue for the current period by applying average exchange rates of the previous period.

[11] The 2022 figures include restatements following the first application of IFRS 17 “Insurance contracts” in 2023.

[12] Free cash flow: cash flow after interest and taxes (excluding dividends received from listed companies) less tangible and intangible investments net of disposals +/- change in working capital requirement.

[13] Excluding €880m of capital loss on Nissan shares disposal.

[14] 10 new vehicles launches in 2024 without Renault Duster (outside Europe) and Captur facelift.

[15] 7 new vehicles launches for Renault Brand in 2024 without Renault Duster (outside Europe) and Captur facelift.